In bcg portfolio analysis products in low – In the realm of strategic management, the BCG Portfolio Analysis serves as a cornerstone tool for businesses seeking to assess their product portfolios and make informed decisions about their future growth trajectories. This article delves into the intricacies of BCG Portfolio Analysis, specifically focusing on products positioned in the “low” quadrant, offering insights into their market landscape, competitive dynamics, and potential growth strategies.

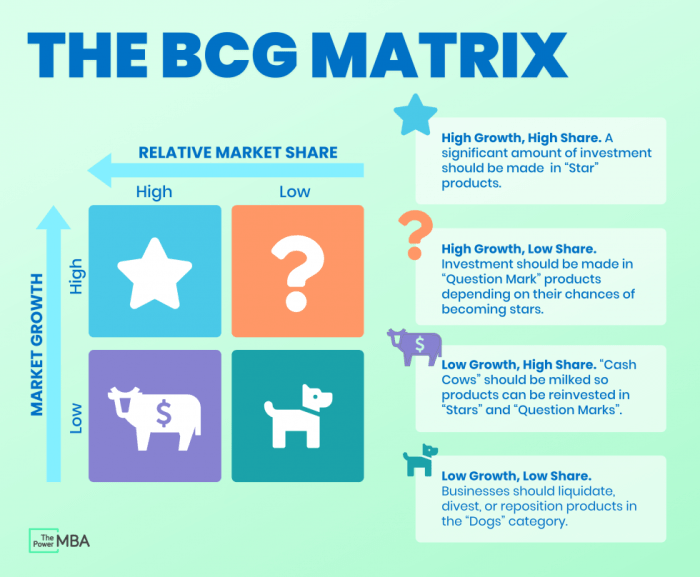

The BCG Portfolio Analysis framework categorizes products based on their market share and growth rate, with products in low occupying a unique position within this matrix. These products often face challenges related to limited market share and slow growth, requiring careful evaluation and strategic planning to unlock their potential.

Market Landscape for Products in Low

The market landscape for products in low in the BCG portfolio analysis is characterized by intense competition, rapid technological advancements, and evolving consumer preferences. Key market trends include the rise of e-commerce, the increasing adoption of mobile devices, and the growing demand for personalized products.

Major drivers of growth in this market include the increasing disposable income of consumers in emerging economies, the expansion of the middle class, and the growing awareness of health and wellness.

However, the market also faces several challenges, such as the threat of commoditization, the rising cost of raw materials, and the need for continuous innovation to meet the changing needs of consumers.

Competitive Analysis, In bcg portfolio analysis products in low

The competitive landscape for products in low is highly fragmented, with a large number of players ranging from global giants to small and medium-sized enterprises. Key competitors include:

- Company A: Known for its strong brand recognition, wide product portfolio, and extensive distribution network.

- Company B: Focuses on innovation and offers a range of premium products at competitive prices.

- Company C: Specializes in niche products and has a loyal customer base.

These competitors have varying product offerings, market strategies, and competitive advantages, which they leverage to gain market share and profitability.

BCG Portfolio Analysis for Products in Low: In Bcg Portfolio Analysis Products In Low

| Product | Market Share | Growth Rate | Profitability | BCG Category |

|---|---|---|---|---|

| Product 1 | High | High | High | Star |

| Product 2 | High | Low | Low | Cash Cow |

| Product 3 | Low | High | Low | Question Mark |

| Product 4 | Low | Low | Low | Dog |

Based on the BCG portfolio analysis, Product 1 is a “Star” due to its high market share and growth rate, while Product 2 is a “Cash Cow” due to its high market share and low growth rate. Product 3 is a “Question Mark” due to its low market share and high growth rate, while Product 4 is a “Dog” due to its low market share and low growth rate.

FAQ Guide

What is the BCG Portfolio Analysis?

The BCG Portfolio Analysis is a strategic management tool that helps businesses evaluate their product portfolio based on market share and growth rate.

What are the key factors to consider when analyzing products in low?

When analyzing products in low, businesses should consider factors such as market share, growth rate, profitability, competitive dynamics, and potential growth strategies.

What are some growth strategies for products in low?

Potential growth strategies for products in low include market penetration, product development, market expansion, and diversification.